Page 200 - Una innovación a la mecánica cuántica

P. 200

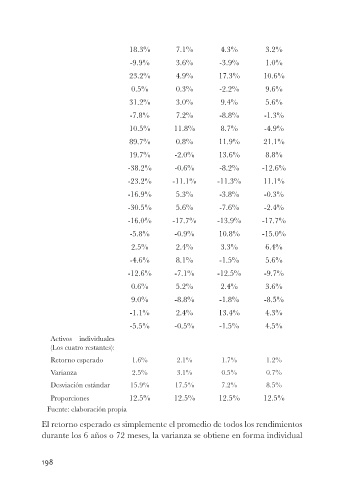

18.3% 7.1% 4.3% 3.2%

-9.9% 3.6% -3.9% 1.0%

23.2% 4.9% 17.3% 10.6%

0.5% 0.3% -2.2% 9.6%

31.2% 3.0% 9.4% 5.6%

-7.8% 7.2% -8.8% -1.3%

10.5% 11.8% 8.7% -4.9%

89.7% 0.8% 11.9% 21.1%

19.7% -2.0% 13.6% 8.8%

-38.2% -0.6% -8.2% -12.6%

-23.2% -11.1% -11.3% 11.1%

-16.9% 5.3% -3.8% -0.3%

-30.5% 5.6% -7.6% -2.4%

-16.0% -17.7% -13.9% -17.7%

-5.8% -0.9% 10.8% -15.0%

2.5% 2.4% 3.3% 6.4%

-4.6% 8.1% -1.5% 5.6%

-12.6% -7.1% -12.5% -9.7%

0.6% 5.2% 2.4% 3.6%

9.0% -8.8% -1.8% -8.5%

-1.1% 2.4% 13.4% 4.3%

-5.5% -0.5% -1.5% 4.5%

Activos individuales

(Los cuatro restantes):

Retorno esperado 1.6% 2.1% 1.7% 1.2%

Varianza 2.5% 3.1% 0.5% 0.7%

Desviación estándar 15.9% 17.5% 7.2% 8.5%

Proporciones 12.5% 12.5% 12.5% 12.5%

Fuente: elaboración propia

El retorno esperado es simplemente el promedio de todos los rendimientos

durante los 6 años o 72 meses, la varianza se obtiene en forma individual

198